I am currently reading Destiny of the Republic by Candice Millard – and excellent book that details the election and assassination of President James Garfield. While reading today I came across a part I though my dad would find particularly interesting (as he works in HVAC and Comfort Systems). Quickly, I paraphrased this portion of the book and emailed it to him. In turn, he responded with a historical connection to the industry in which I am employed – printing.

I found the link between our two professions truly fascinating and wanted to share it here. The paraphrased narrative, and my father’s response, were basically as follows:

During the particularly hot summer of July 1881, the US Navy Core of Engineers and John Wesley Powell set about to create a system to cool the bedroom of the recently shot President James Garfield.

Using three tons of ice, and an elaborate system comprised of a 36” electric fan that forced air through cheese cloth screens that had been soaked in ice water and placed in a 6 foot long iron box, air was conducted to James Garfield’s bedroom through a series of tin pipes. Although the system worked (the air entered the pipes at miraculously cool 55 degrees) the cheesecloth made the air heavily humid. Worse still, even though the majority of the cooling contraption was in Garfield’s adjacent office, the contestant whirring and grinding of the fan caused an ear-splitting racket.

Undeterred, the engineers set to fix the problems.

First they set a 134 gallon ice box between the iron box and the pipes in order to dry the air. Then, realizing that the tin pipes actually amplified the noise, they replaced them with pipes made of canvas covered wire; which absorbed the sounds.

Twenty years later, the first modern electrical air conditioner was invented by Willis Havilland Carrier of Syracuse, NY.

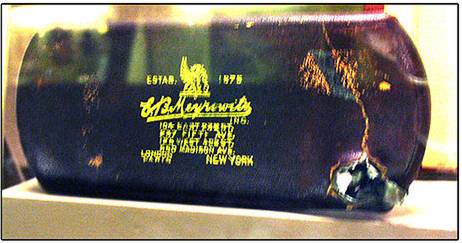

Now, Carrier actually worked for a large printing company (Sackett-Wilhelms Lithography) and high summer humidity in New York was often a problem. Paper would swell with moisture (unevenly, of course) and would then become misaligned in the huge presses. Also, ink took longer to dry in humid air; causing smears and ink transfer from page to page.

Carrier knew that he could use steam to heat buildings and reasoned that by altering the process he could lower temperature – and therefore lower the amount of humidity that the air could hold.

Instead of forcing air over steam coils, he blew air over coils filled with cold water.

The lower heat and humidity improved the manufacturing process (which was his goal). Human comfort was just a by-product.